The digital health sector took center stage at CES 2025, highlighting solutions designed to empower patients and alleviate the burden on overstretched healthcare systems. However, as innovators race to develop cutting-edge tools, the path to commercialization and widespread adoption remains a steep climb for most startups and small companies.

Following CES 2025, we examine the barriers to health tech innovation, explore examples of success, and identify opportunities for strategic collaboration to drive breakthrough discoveries and engineering advancements.

The United States is grappling with a healthcare crisis. Chronic diseases such as diabetes and obesity are on the rise, placing an unsustainable burden on an already strained system. With too many patients and too few doctors, access to care is dwindling, and costs are skyrocketing.

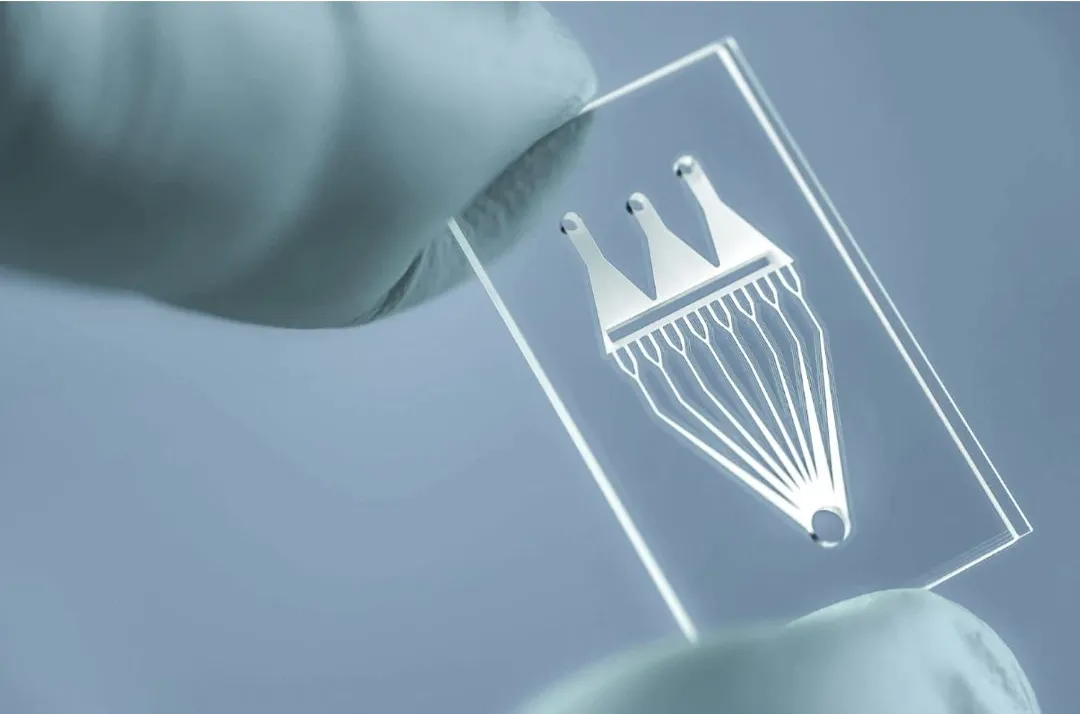

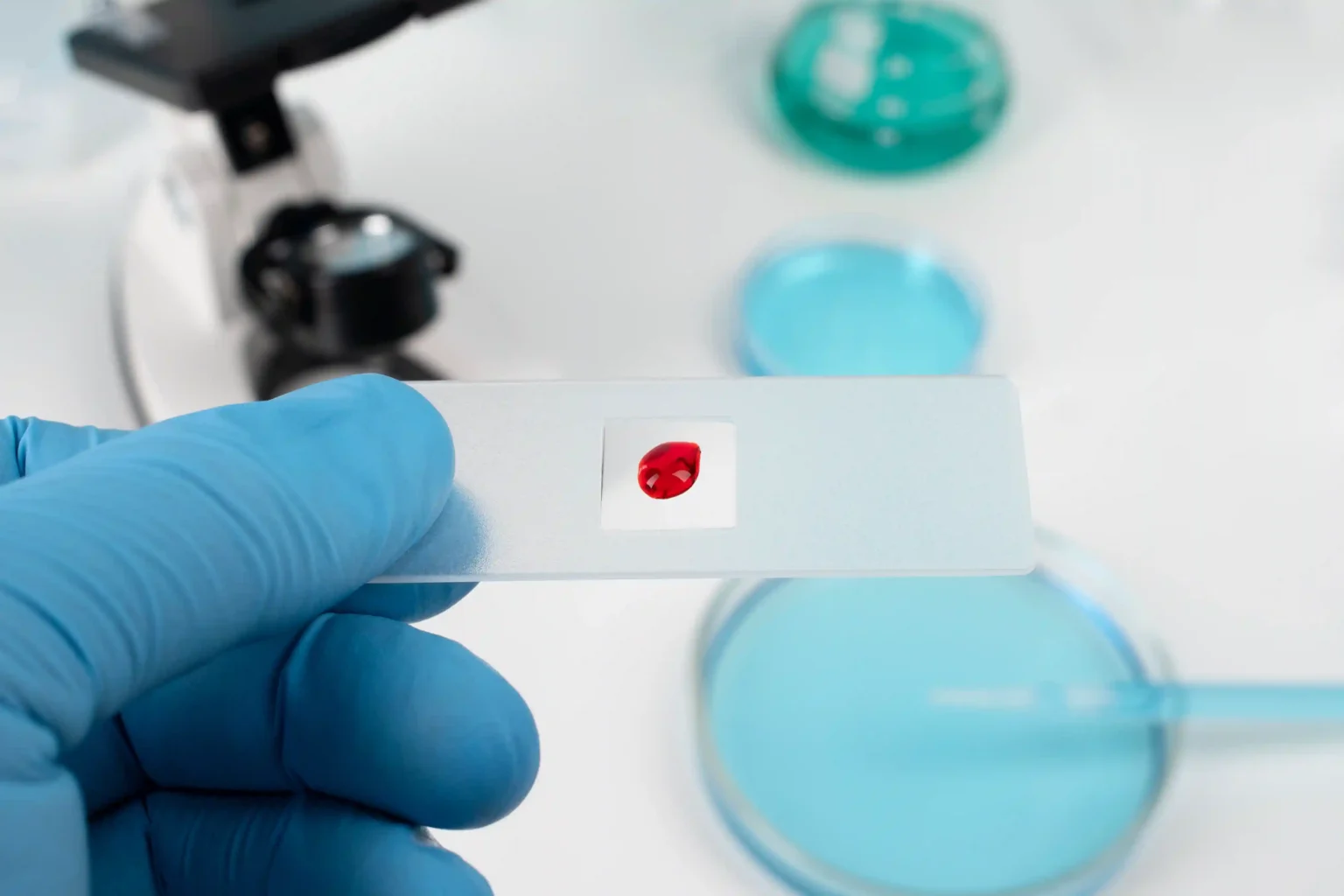

For example, OnMed’s telehealth kiosks bring healthcare services to underserved communities, while Withings’ smart devices offer continuous health monitoring for conditions like hypertension and sleep apnea. Orange Biomed is pioneering portable diagnostic tools that deliver lab-grade A1C testing accuracy on the go. These CES health tech innovations not only represent a paradigm shift in healthcare delivery, but their success also hinges on overcoming significant barriers to commercialization and adoption.

One of the most striking observations from CES 2025 is the disparity between established health tech brands and startups. While major players demonstrate consistent innovation momentum year after year, many smaller companies bring groundbreaking discoveries to the table only to disappear by the following year. The high cost of commercializing devices is a key factor behind this trend.

Even when endowed with significant funding, why do so many promising devices fail to gain traction? Our analysis shows that commercialization failures usually lie in one or more of three critical areas:

Health tech device companies must delve into these three areas to further understand how to overcome the risks of failure and pave the path toward successful commercialization.

First, while many devices come close to replicating the accuracy of medical-grade equipment, they often fall short of replacing traditional healthcare solutions entirely. They also fail to make providers’ lives easier or reduce their workload. To succeed, new devices must not only be accurate but also demonstrate measurable efficiency gains for both patients and providers.

Second, successful adoption requires solutions that fit seamlessly into users’ lives. Devices must be reliable, easy to use, and integrate into daily routines without disruption. Costly gadgets that cater to niche markets or require significant training, upkeep, or maintenance are unlikely to gain widespread acceptance.

Finally, consumers and healthcare providers are inherently conservative when it comes to adopting new hardware and devices. Solutions that integrate with existing technologies—such as smartphones—have a distinct advantage. The future of digital health lies in solutions that meet users where they are, rather than forcing them to change their behavior.

This is where Orange Biomed’s expertise comes into play. After years of developing user-centric, clinically validated health tech solutions, this South Korean startup is transitioning to commercialization after securing additional funding from global investors. “Taking any health tech innovation to market requires building and leveraging a global multi-player ecosystem,” confirms Orange Biomed’s CEO and Co-Founder Yeaseul Park.

The challenges facing digital health cannot be solved in isolation. Collaboration between innovators, investors, and clinicians is essential to drive meaningful progress.

CES 2025 has underscored the transformative potential of digital health, but it has also highlighted the challenges of bringing these innovations to market. To succeed in this rapidly evolving landscape, companies must prioritize capital raising, collaboration, user-centric design, and clinical validation.

The path forward lies in forging strategic partnerships with innovators like Orange Biomed and leveraging South Korea’s leadership in AI and microelectronics.

Major industry players can create more opportunities to bring together innovators of advanced technologies and healthcare facilities to shape and validate evidence-based outcomes for new technologies. There is no shortage of chronic diseases that require cost-effective solutions, including diabetes, cancer, obesity, mental health, and so many more.

Such collaborations can accelerate the introduction of solutions that not only address today’s healthcare challenges but also pave the way for a healthier, more sustainable future.